As an avid reader of Medium, a social publishing platform, and a technical-oriented person, it was amusing to see the amount of ChatGPT articles written almost every day. ChatGPT has been stealing the show for quite a while. From content creation to money making, it is being used everywhere. This blog takes on an approach toward the usage of ChatGPT in the transformation of the world of finance. But first, let’s take a quick look at what is ChatGPT and what is the buzz all about.

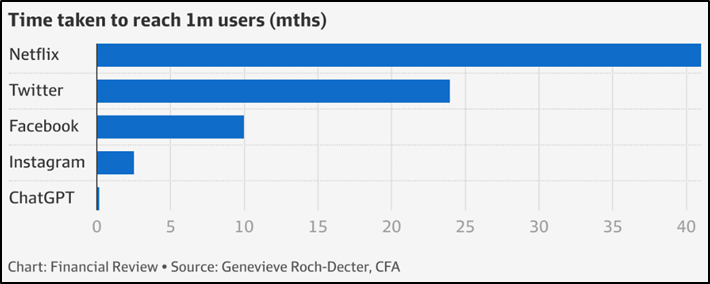

A revolutionizing model created by OpenAI, ChatGPT can understand and interpret the human language as it is trained on a core of a massive dataset and using the best of machine learning. Following its release in November 2022, it greatly boosted its audience. With its ability to interact in a conversational dialogue form, it appears to present itself as an interaction with humans. It uses techniques like supervised and reinforcement learning to learn its model and enhance the search results. The graph below shows the phenomenal growth of ChatGPT in comparison to a few of the most famous technologies.

From risk assessment and portfolio management to financial forecasting and predictive analytics, ChatGPT has the potential to provide insights into a vast domain. The financial industry has always been driven by data and analysis, and with the rapid advancements in artificial intelligence, this trend is only set to continue.

One of the most promising applications of ChatGPT in finance is its ability to assist in risk assessment. By analyzing large amounts of financial data, ChatGPT can help identify potential risks and assist in decision-making processes. This includes everything from portfolio management to credit risk analysis. With its ability to process and analyze large amounts of data quickly, ChatGPT can help financial professionals make more informed decisions, faster.

Take a look at the below prompt. It took less than a minute for ChatGPT to process the financial statements of Reliance Power Limited for the year 2021-22 and provide a detailed analysis of the financial ratios and a brief interpretation of the same.

In addition to risk assessment and portfolio management, ChatGPT can also be used for financial forecasting. By analyzing historical financial data, ChatGPT can make predictions about future market trends and provide valuable insights for financial professionals. Whether it's predicting future stock prices or identifying potential investment opportunities, ChatGPT has the potential to significantly improve financial forecasting.

With improved decision-making, personalized dialogue-like interactions, and increased efficiency, ChatGPT can have a huge range of utilities including:

Portfolio Management and Risk Assessment: As mentioned before, analyzing a portfolio and suggesting changes to optimize the returns and minimize the risk can be easily done by ChatGPT.

Customer Service: ChatGPT can be integrated into financial institutions' customer service platforms to provide 24/7 support to customers. It can handle routine inquiries, provide investment advice, and assist with account management.

Fraud detection: ChatGPT can be trained on historical financial data to identify patterns and anomalies that may indicate fraudulent activity. This can help financial institutions detect and prevent fraud more effectively.

Financial predictions and analysis: ChatGPT can analyze vast amounts of financial data and generate predictions on stock prices, market trends, and other financial metrics. This can help financial professionals make informed investment decisions.

However, as important as data is in making predictions of financials, a lack of authentic data can result in the loss of accuracy and thus limitations are born. ChatGPT as much as a boon also has its disadvantages and limitations. They can be listed as follows:

Accuracy: The decisions taken by ChatGPT are solely based on the data provided by the users and the data that it is trained on. Hence, with changing market trends, the predictability of the model also decreases or drastically changes.

Input Limitations: ChatGPT is a text-based chat interface model and hence cannot handle file uploads. This puts a restriction on the data that can be utilized for the analysis.

Cost: Implementing and using ChatGPT in the financial industry can be expensive. This includes the cost of acquiring the technology, training the model, and maintaining it over time.

Lack of Regulation: Currently, there is limited regulation around the use of AI in finance. This can lead to ethical concerns and the potential for misuse.

In conclusion, ChatGPT has proven to be a valuable tool in the world of finance. Its ability to understand and analyze large amounts of data and advanced language processing skills make it capable of providing insightful and accurate information on a wide range of financial topics. As technology continues to evolve, ChatGPT will likely become an even more indispensable tool in the financial industry. Also, with new technologies coming up with core as GPT3 like WellyBox, ChatGPT will evolve in even broader domains. With its 24/7 availability and ease of access, it's no wonder why ChatGPT is quickly becoming a go-to source for financial information and analysis.

.png)

Comments